ストライダー 移動用カバー

(税込) 送料込み

商品の説明

ストライダーの大会時のために購入したので頻度少なめです。汚れ、傷などあるかもしれないためこの評価です。男女持てる優しい色柄で使いやすいです。

商品の情報

| カテゴリー | 車・バイク・自転車 > 自転車 > アクセサリー |

|---|---|

| 商品の状態 | やや傷や汚れあり |

楽天市場】ハローエンジェル ペダル無し2輪自転車専用バッグ 4way 3

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

aile サドルカバー ストライダー ペダルなし自転車 キックバイク カバー 子供 幼児 ストライダー用 無地

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

ストライダー14x スペアパーツ フロントチェーンカバーセット-STRIDER公式オンラインショップ

自転車カバー 防水カバー レインカバー サイクルカバー 子供用

新色登場!12インチストライダー用キャリーバッグFREDRIK PACKERS

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

値下げ!ストライダー グリーン エルボー&ニーパッド ヘルメット

ストライダー ケース - フライトスーツ

【ストラリュック配布終了】ストライダー 14x(フォーティーンエックス)-STRIDER公式オンラインショップ

ストライダー - 移動用品

楽天市場】【常時発行!LINE友達登録で300円OFFクーポン!!】【選べる2色

ストライダー14x スペアパーツ リアチェーンカバー-STRIDER公式オンラインショップ

値下げ!ストライダー グリーン エルボー&ニーパッド ヘルメット

ストラリュック配布終了】ストライダー 14x(フォーティーンエックス

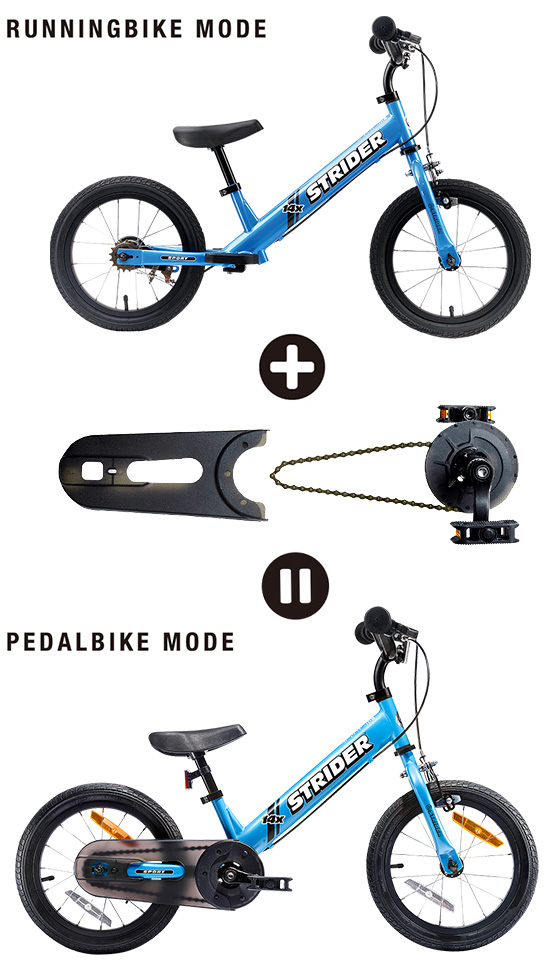

ペダルを装着できる14インチストライダー|STRIDER 14x

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

ストライダー 持ち運びベルト キャリーバッグ キッズバイク 肩掛け

ペダルを装着できる14インチストライダー|STRIDER 14x

ストライダー + カバー + 車輪止め | フリマアプリ ラクマ

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

新色登場!12インチストライダー用キャリーバッグFREDRIK PACKERS

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

ストライダー専用キャリーバッグに新色登場!

☆ ストライダー 黄緑 グリーンの通販 by クローバー's shop|ラクマ

ストライダー専用キャリーバッグに新色登場!

新色登場!12インチストライダー用キャリーバッグFREDRIK PACKERS

![Amazon.co.jp: [ANOTHER DIMENSION] ストライダー キャリーベルト](https://m.media-amazon.com/images/I/71d9oxU-fnL._AC_UY580_.jpg)

Amazon.co.jp: [ANOTHER DIMENSION] ストライダー キャリーベルト

ペダルを装着できる14インチストライダー|STRIDER 14x

自転車ストライダー 赤 バランスバイク スタンド付き - amsfilling.com

STRIDER ストライダースポーツ キャリーケース付き 外出/移動用品

ペダルを装着できる14インチストライダー|STRIDER 14x

新規取扱開始!ランニングバイク兼子供用自転車「STRIDER 14X

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

ストライダー シリコン入りサドルカバー付き | フリマアプリ ラクマ

楽天市場】ストライダー バッグ ストライダー の 持ち運び に便利な

新色登場!12インチストライダー用キャリーバッグFREDRIK PACKERS

ストライダーの持ち運びが地味に大変!2つの必殺技でスムーズに解決

ストライダー + カバー + 車輪止めの通販 by たまたま's shop|ラクマ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています