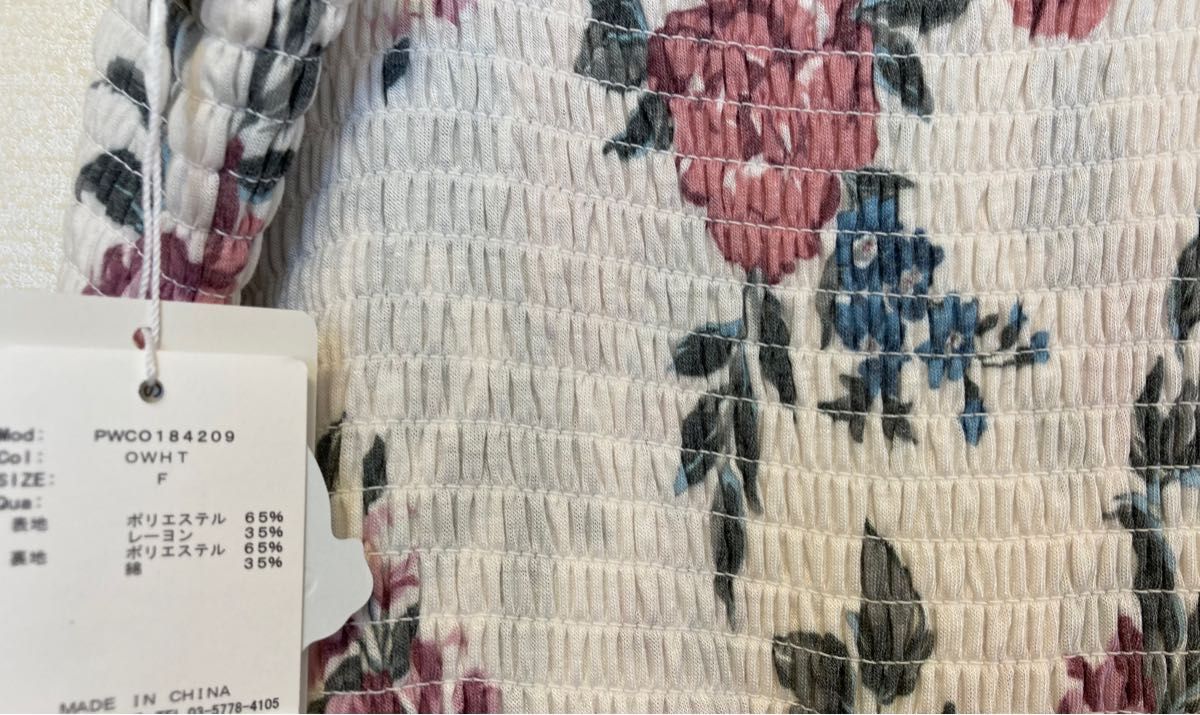

【新品未使用】ジェラピケ ルームウェア ワンピース

(税込) 送料込み

商品の説明

gelatopiqué

袖丈···半袖

カラー···ホワイト

柄・デザイン···ボーダー

季節感···春

季節感···春、夏商品の情報

| カテゴリー | ファッション > レディース > ルームウェア・パジャマ |

|---|---|

| 商品のサイズ | FREE SIZE |

| ブランド | ジェラートピケ |

| 商品の状態 | 新品、未使用 |

ルームウェア/パジャマ新品ジェラピケワンピース - ルームウェア

新品未使用》ジェラートピケ ルームウェア ワンピース 部屋着

ジェラートピケ マタニティ ガーゼワンピース ルームウェア 新品未使用

ジェラートピケ ルームウェア ワンピース - パジャマ

柄デザイン無地【未使用・新品】ジェラートピケ ルームウェア

ジェラートピケ ルームウェア ワンピース - パジャマ

新品未使用 ジェラピケルームウェア 花柄 ワンピース ドレス

ワンピース | gelato pique(ジェラートピケ) | レディース

新品未使用【ジェラートピケ】gelato pique さがらドレス ワンピース

ジェラートピケ ルームウェア パジャマ ワンピース フリーサイズ

☆新品未使用☆韓国ファッション☆ミッフィー☆ルームウェア☆パジャマ☆ワンピース | フリマアプリ ラクマ

新品未使用】ジェラートピケ ワンピース 部屋着 星座柄ラップ

ジェラートピケ マタニティ ガーゼワンピース ルームウェア 新品未使用

スーパーセール 【新品未使用・タグ付き】ジェラピケ ルームウェア

yo様専用 【新品未使用】ジェラートピケ 星空アニマルワンピース

新品未使用*ジェラピケルームウェア 花柄 ワンピース ドレス ジェラートピケ

新品未使用 ジェラピケルームウェア 花柄 ワンピース ドレス

ジェラピケルームウェアワンピース - パジャマ

jzdejavuNEW。ジェラートピケ:ケーキボーダー ワンピース ルーム

ワンピなど最旬ア! 【未使用】ジェラピケ スヌーピー ジェラートピケ

新品 gelato pique トイプードル 柄 パジャマ 部屋着 ロングワンピース

新品未使用*ジェラピケルームウェア 花柄 ワンピース ドレス ジェラートピケ | フリマアプリ ラクマ

新品】 ジェラピケ ジェラートピケ パンダ柄ワンピース新品未使用タグ

☆未使用☆タグ付き!ジェラートピケ ルームウェア ワンピース

ジェラピケ ジャガードワンピース トイプードル ピンク新品未使用の

高級感 未使用 ジェラピケ 未使用品ルームウェア ドットチュールドレス

ワンピース | gelato pique(ジェラートピケ) | レディース

未使用】ジェラートピケ ルームウェア ワンピース マタニティ

ジェラートピケ 白ワンピース ルームウェア(レディース)の通販 16点

ジェラートピケ マタニティ ガーゼワンピース ルームウェア 新品未使用

新品未使用 gelatopique ジェラピケ ワンピース ルームウェア 妊婦 by

ジェラピケ ルームウェア オールインワン 部屋着 パジャマ 新品未使用

楽天市場】ジェラートピケ ワンピース(ナイトウェア・ルームウェア

ジェラピケ 新品未使用 ジェラートピケ ミモザワンピース - パジャマ

ジェラートピケ ルームウェア ワンピース 花柄 - ルームウェア・パジャマ

新品未使用☆gelato pique アグリーベアジャガードワンピース

新品 未使用 ジェラートピケ コアラ ワンポイント Tシャツ&コアラ

【新品・未使用】ジェラートピケ プリン柄ワンピース

開店記念セール! 【未使用】ジェラピケ パンダ ルームウェア

☆未使用☆タグ付き!ジェラートピケ ルームウェア ワンピース

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています